Corporate Background

MPV Established in 2017, MPV is run by a strong team of professionals that have extensive experience in real estate markets as well as the finance industry. We have a unique marketing strategy in line with the ever-changing real estate markets. In addition, the team behind MPV has worked with an international technical team to create a solid blockchain application and technology ecosystem. In this Fintech era, MPV has created a new paradigm for real estate investment through an innovative digital asset platform.

MPV Vision

MPV's vision is to bring new value into the real estate industry, helping more people to easily participate in buying or investing in real estate via a revolutionary digital platform that opens up a whole new world in real estate investment.

MPV Mission

MPV's mission is to provide a digital asset platform built on blockchain technology which connects more people with quality real estate from around the world, so that everyone has the opportunity to own real estate with ease.

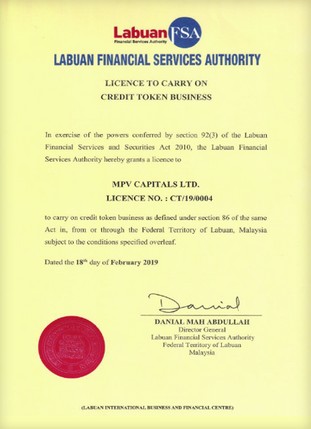

Credit Token Business & Digital Financial Services

Our company is licensed by the Labuan Financial Services Authority (Labuan FSA) to operate a Credit Token Business, ensuring full compliance with Labuan's regulatory standards under the Labuan Financial Services and Securities Act 2010 (LFSSA). This accreditation provides our clients with the assurance that our services meet stringent financial and legal requirements.

In addition to our credit token business, we also operate as a Digital Financial Services Provider, governed and regulated by Labuan FSA. This designation reinforces our commitment to offering secure, compliant, and innovative digital financial solutions while adhering to Labuan’s financial regulations. It is important to note that, under the LFSSA, Labuan-based enterprises are restricted from conducting business in ringgit currency.

Our Members

Company Flow

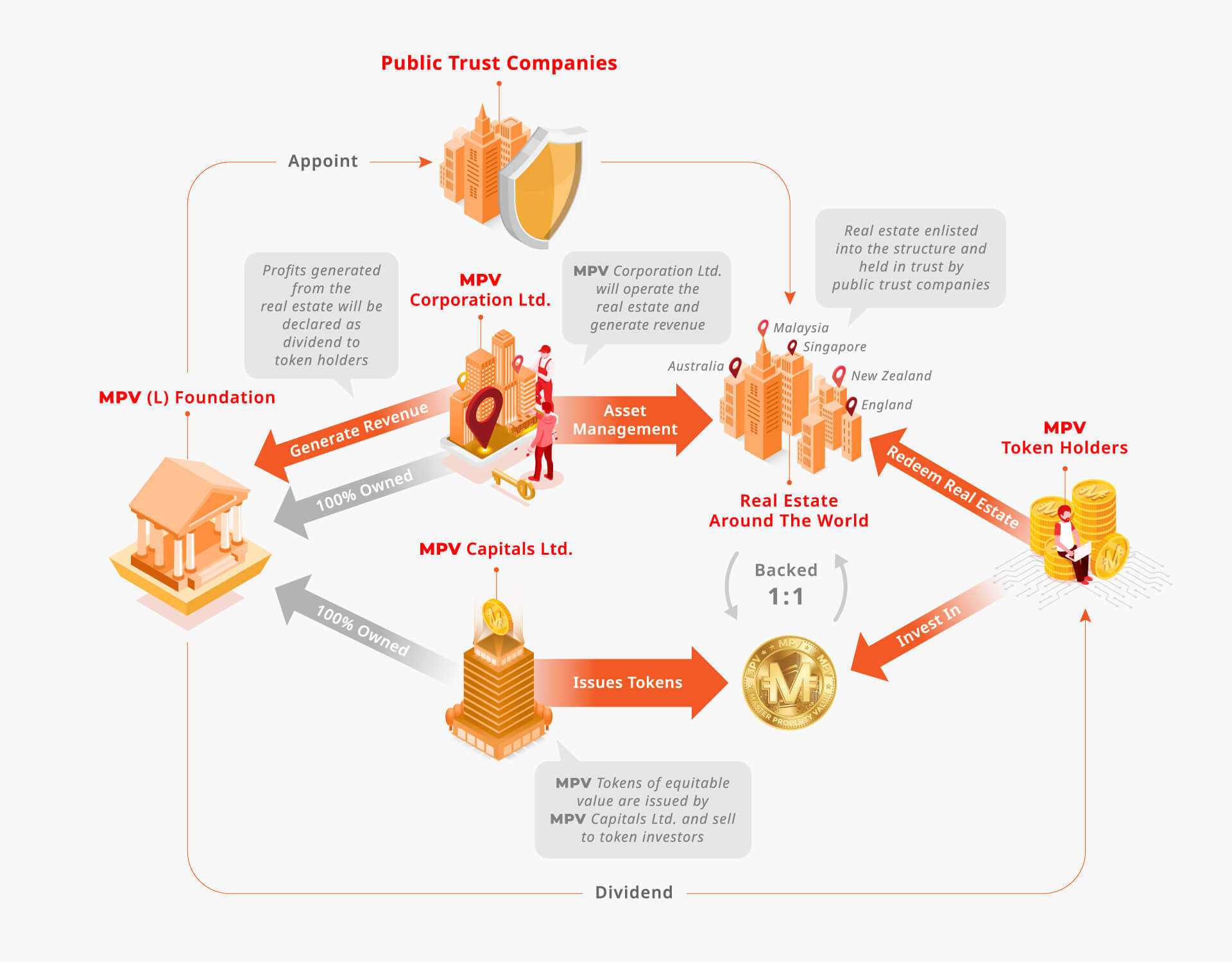

Similar to traditional REITs, credit tokens are issued by physical housing. Real estate support and regulation through independent trust companies to ensure ownership of real estate.

MPV investment structure from all types of real estate around the world, there will be a professional asset management team which is owned by the MPV (L) Foundation. The Foundation also owns an MPV Capitals Ltd, the company that issues MPV tokens. MPV Token will be 1:1 ratio to the backed properties

MPV token holders are beneficiaries of the MPV Foundation which managed by the asset management team. Revenue generated by real estate investment projects will be distributed as dividends to MPV token holders.

The dividend is paid is included in tax and after-tax is recorded for the period. After the profits, the payment of dividends will be announced by MPV Foundation. The number of MPV tokens issued depends on the market value of the new asset matches the current MPV token price.

Contact No

Copyright © 2025 MPV All Rights Reserved.